Every company in Poland has a unique TIN number, which allows it to be identified in databases. Using official records, such as the Central Statistical Office (CSO), it is possible to automatically retrieve detailed information about a company, including its name, address and business status, based on its TIN number.

The CSO makes all the data in its database available through a free API. By automating this process in your PrestaShop store, you can significantly speed up the registration of B2B customers, improve data quality and reduce errors resulting from manual entry of information.

Why you should automate

downloading company data from GUS?

Entering company data manually leads to mistakes and incomplete information, which can cause errors when issuing invoices.

Automatically downloading data from the CSO based on TIN solves this problem.

By automating the download of data from the CSO, the entire process of registering a business customer becomes much simpler and faster. All the customer has to do is enter his/her TIN number and the system will automatically fill out the registration form.

Benefits of integration with GUS

- Reduced registration time - the customer only enters the TIN, and the rest of the data fills in on its own.

- Elimination of errors - data is downloaded directly from GUS, which ensures its correctness.

- Easy verification of companies - the store can automatically check whether a given TIN is active.

- Hassle-free invoicing - the correctness of the data is guaranteed by the compatibility of accounting documents.

How to integrate CSO with PrestaShop?

In order to fully automate the process of retrieving company data from GUS based on the TIN number in PrestaShop, we created the PrestaShop Tax Number Validator module. This module integrates with the CSO API and allows you to instantly retrieve company data during customer registration or when placing an order.

How does the automatic data download work?

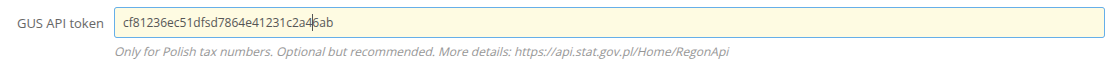

- Get your API key from the GUS website

- Enter your GUS API key in the module configuration.

- The customer enters the Tax ID number when registering, providing a new address or creating an order.

- The module connects to the GUS database and downloads company data.

- The registration form completes automatically.

Additional features of the module

PrestaShop Tax Number Validator

- 5.0

Free support BEST150,00 EUR

The Tax Number Validator module not only retrieves data from the CSO, but also offers additional features to help you drive B2B sales:

- EU VAT and UK VAT verification - checking whether a company has an active VAT number in the VIES, VATapp and gov.uk databases

- Automatic setting of 0% VAT rate for EU companies - helpful for B2B sellers operating in international markets.

- TINvalidation capability - checking that the provided TINnumber is correct and actually exists.

- Query history and reports - recording of downloaded data and possibility to analyze it.

Why you should...

Implement automatic downloading of CSO data in PrestaShop?

Automating the retrieval of company data based on VAT number is the key to streamlining the ordering process for B2B customers in PrestaShop stores. The Tax Number Validator module provides fast, accurate and fully automated data retrieval, making it easier to run your business and improve the customer experience.

Want to learn more? Head over to the module' s page and see how it can improve the process of serving businesses in your PrestaShop store!